Breaking The First Rule When Analyzing Analysis

Does X really mark the spot on income inequality? That’s what Stan Sorscher of the Economic Opportunity Institute believes and noted in an August 2015 column that was shared by a friend on Facebook this morning. Instead of writing a long rant on Facebook, however, I’ve decided to post some thoughts here and then, others can join in if they like. Sorscher offers interesting but flawed analysis.

First, it’s clear that he bends toward socialism/communism and doesn’t personally believe in capitalism. This isn’t a problem; people can believe what they want to believe. But, it’s enough to discredit any of his analytical thought if the person offering the analysis leads with personal political preference to come to a conclusion instead of making a conclusion based on the data. It’s the first rule of any analysis: remove your personal beliefs and just view the data for what it is. Sorscher also ignores (and outright pooh-poohs) many other factors in the separation of wealth and productivity which all play a role and, instead, embraces socialist dogma.

But take all that anti-capitalist nature of his column and move ahead …

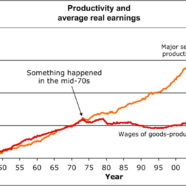

First, his timeline is wrong about “greed is good.” That didn’t start in 1973-1974; that mentality took hold in the early-1980s, about eight-plus years after the separation began. Many of us lived through this, if we recall. Something that happens after the initial cause of separation didn’t cause the separation. It may be a result of the separation – although you can see a projected increase in the wages of goods-producing workers from 1980 to 1987, just before the recession – but it didn’t cause separation.

Ignoring the oil crisis shock is a problem with this analysis, too. It started in late 1973 – at nearly the same time of the separation – and instantly doubled the cost of fuel on every sector of the economy – home heating oil, transportation, etc. Everything. With that, increased costs for consumers on every sector affected by the oil crisis also increased. That made prices go up on nearly every sector of the economy – with no reciprocal increase in wages for ordinary people, since the main benefactors of the oil crisis were OPEC nations – wealth shipped overseas – and investors. While productivity naturally grew, as it had before, any benefits separated and/or were erased.

Sidebar: back in 2010, gas prices went up from about $2.59 a gallon to $2.73 a gallon in a few days. Instantly, I noticed that prices at Market Basket increased instantly, as a noted on one of my websites at the time: boneless chicken increased by a dollar, sour cream went up 10 cents, Mexican cheese went from $1.69 to $1.89. Bananas went from 33 cents a pound to 49 cents. MB put up signs noting that the increase gas prices was why food prices were going up. When gas prices dropped a few months later, food prices didn’t drop back down on these items, I wrote on my blog later; the new prices were the new norm.

If a 15 cent blip in gas prices did this in 2010, what would an oil crisis do? Gas went from 30 cents to 60 cents overnight and the same ripple effect probably occurred in the economy (I was little; I remember not having oil to heat our apartment because we were poor but I don’t remember if food prices were expensive), while productivity is still increasing. This requires deeper analysis (and my personal opinion is that this is one of the main factors of the start of the separation – any productivity gains were being eaten up by higher costs nearly everywhere).

Back to the main arguments: Exempt and non-exempt changes – which sometimes come with higher wages for workers than they would without that status (or an extra part-time job to sustain the expense of a current lifestyle) are not addressed at all in this analysis. As noted previously in May 2016, when the Obama administration attempted to change the overtime rule, this has negative and positive consequences.

Neither of my parents, as an example, and probably yours, too, ever had a 70 hour workweek. That’s been my norm for a very long time, due to requirement to get the job done and choice. Combine that with changes in various job sectors – some that don’t even make a profit – and you can see how charts would show separation. Here’s what the equation: X worker produces X2 productivity but Y profit is still produced while Z is earned either way: Higher productivity with no worker benefit.

Technology is not addressed at all in this analysis. As I noted on Facebook earlier this year, an inexpensive smartphone – say, $250 – has about $2,500 worth of technology in it if you had to buy all of the technology separately. Higher productivity costs less money than it did before yielding higher productivity at the same rate of earnings.

Sorscher’s concept of “work has dignity” is interesting when he ignores and downplays the “poor choices” argument and the “moochers and parasites” analogy. He’s correct – any work should be respected – but with that logic, any non-work should be disrespected because it burdens everyone else. He belittles these concerns. A higher percentage of our workers today are not working due to all kinds of reasons like phony disability claims and other things while workers who are working are increasing productivity due to demands (Note this blog post on Politizine from 2013 on disability rolls swelling. That guy wasn’t disabled … he’s riding around on his Harley, on our dime, refusing to get whatever job he can like everyone else has to do, SMH). Sorscher may be correct that we all shouldn’t judge others. But when tens of millions are not working and making demands on the ones who are working or, they are working in government sectors and making demands that are simply not sustainable to the rest of us, why shouldn’t those who have skin in the game be allowed to judge? Help row the boat and stop complaining. The rich are already doing more than others as already shown. Again, 95 percent of the federal income taxes are paid by the Top 20 percent of wage earners.

He also ignores the fact that workers can easily share in the benefits of their productivity by purchasing shares, when applicable, of the companies they work for or other companies. This requires a saving mentality which, again, is a lifestyle choice. If one chooses to spend their money instead, that is their choice, too. We can all agree that many people don’t have that extra money. But it can be found if there is wherewithal. It’s called sacrificing. He can argue that there used to be private sector pensions (he doesn’t) and those are gone for most private sector workers (while we’re also having to pay for the public sector pensions and the multi-trillion pension liabilities on the horizon in that sector).

The writer also ignores Nixon’s trip to China in 1972 which opened the doors to businesses that sought to lower wages for creating products for sale in the United States. This would take on massively, years later, in the 1990s, after PMFN trade status with China and is shown in his data – although he ignores it (see his Real Family Income chart and the separation beginning to zoom up in 1995 after the early 1990s recession; although all incomes gained, the top gained a bit more because they are the investor class, wealth begets more wealth, etc. Taking all the wealth from the rich and filtering it down to the masses doesn’t make us all rich; there isn’t enough money. It just makes them poor).

Swinging back to the inability for Sorscher to remove his personal political preferences from the analysis for just a second, he also completely ignores globalization which has created much more productivity companies and output here but no reciprocal effect in wages being increased.Globalization beginnings started before the wealth separation of 1973-1974 – which would make it more of a factor than “greed is good,” which, again, started eight-plus years after the separation. Sorscher mentions trade but it’s a blip in the analysis. He also completely ignores stagflation which began in the late 1960s and continued through the 1970s and into the early 1980s. He ignores money manipulation by the Federal Reserve which plays a massive role in the ability of workers to save, what they spend to survive, etc., and ignores the richest bestowed upon those who have wealth to invest, especially in the banking sector as it relates to globalization (very high returns on the expansion into the world).

All of these factors create higher productivity and benefit for the affluent and lower returns for workers (and none of them are corrected by embracing socialism, BTW).

As an aside, Karl Marx wrote in the 1850s, paraphrasing, governments should embrace free trade because it will drive wages down for the working class because first world nations can’t compete with third world nations due to wage discrepancy (even then) and that will drive the masses to communism. This is essentially what we’re seeing today in modern America.