Wealth, Income Inequality, Capitalism …

For sometime now, I’ve been collecting some thoughts about wealth and income inequality, the state of capitalism, and how workers and families start to move forward and increase their standard of living. I was prompted to write some of this after my friend Charlene posted a request from some of her liberal friends on why they hated capitalism. By the time I got done, I had written hundreds of words which doesn’t really work on Facebook. So, I’m putting it here. This is a starting point though; there is a lot more to say, tell, and show. More on that later.

First, some thoughts. Capitalism isn’t really the problem. It’s predatory capitalism along with big government, big business, and big labor suffocating the masses to control more of the country’s money and resources. There is a lot of data flying around out there about the problems but the only way to really tackle it accurately is to take any preconceived political notions out of your brain first before looking at the data. Once you do that, you’ll understand the following things … which then lead to solutions.

* Wealth isn’t “distributed” by some magic wealth fairy … wealth is earned, inherited, won, or stolen. So when people speak about “wealth distribution,” you can’t take anything they say – or actually, feel, it’s emotional – seriously. They don’t have the basic understanding of how a person gets rich, if you will. There are a lot of subsets to this fact. And, yes, the government sectors can assist in improving the business climate and improving the lives of others; it also sometimes plays a negative role in what happens to the individual and the business climate. But wealth is not distributed.

* Income or earnings, the labor participation rate, global competition, outsourcing, and the de-industrialization of the United States, are the main problems why Americans are getting creamed economically today. The data is irrefutable at this point and anyone who doesn’t realize this or gets emotional because of already engrained political beliefs just can’t be engaged with. Please stop relying on what your professor taught you and open your mind to realities.

* Couple the earnings problem with the growing cost of living issue (no one paid for cable TV or cell phones 40 years ago, as an example, so while you can compare today to yesterday, there are other factors…) as well as the growing cost of government, at all levels, more expensive than it has ever been, and that saps everyone’s income (other than the filthy rich), and it’s nearly impossible for anyone to save and build wealth. Every action in the economy has a reaction somewhere else; everything is connected. One could also subset consumer culture and all kinds of other smaller things in here, too, but I don’t want to go off on too much of a tangent.

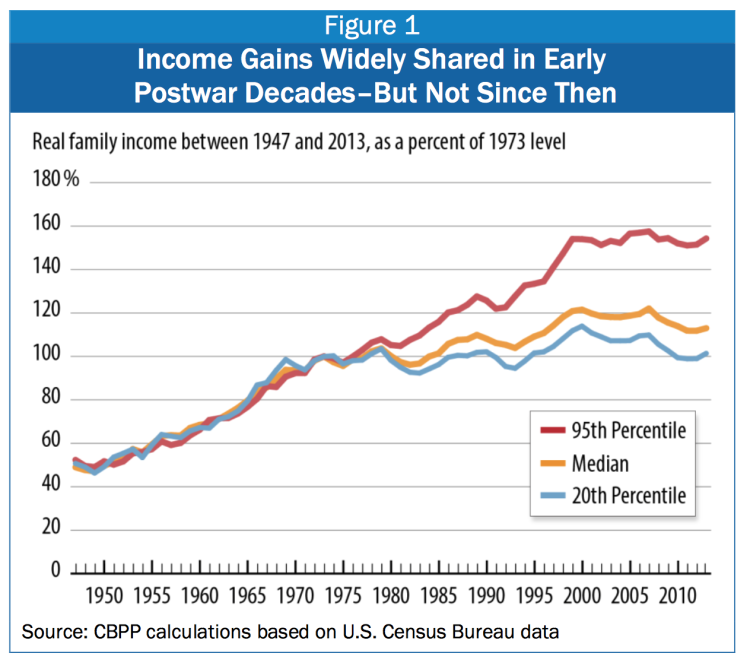

The data then can be traced back to support these conclusions, again, with subsets. See the attached chart from the nonpartisan but left-of-center Center on Budget and Policy Priorities and follow along …

Income/wealth inequality didn’t begin under Ronald Reagan and his “evil” lower taxes on the rich and debt that were approved by a Congress controlled by Democrats. It actually began to separate in the mid-1970s – see the first part of red in the chart start to separate from the rest of the income sectors around 1975. This was mainly due to oil crisis, where nearly everyone in the country – instantly – had huge increases in living expenses. Money that otherwise would have been saved went toward gas, home heating oil, etc. (there were years when living in rural New Hampshire that we went without oil heat completely because it was so expensive and we were so poor). During this time, no one got a raise either based on higher costs. The labor participation rate – see below – was at its lowest in modern history. Those higher fuel costs rippled in the economy creating higher food, clothing, and other costs. This is where the shift first started. And yes, the entire oil crisis was a created, manipulated act.

The Ford-Carter Recession – stagflation, as it was called at the time, mainly doctored by the Federal Reserve keeping interest rates much higher than they needed to be – carried into Reagan’s term and he, along with Tip O’Neill, D-MA, the Speaker of the House, agreed to lower tax rates on all sectors and increase government spending, mainly on the military. The economy grew and wealth and income in ALL sectors grew until about 1989 (the Soviet empire collapsed, too, a mostly positive but also negative thing since we’re fighting multiple wars instead of a single Cold War). The Top 10 percent of wealth holders grew more than the lower earners because they had more money. Again, there is no wealth fairy – wealth begets wealth. A person with $100 in savings earning 5% in a passbook account in 1982 wasn’t earning anywhere near what another person with $900,000 in other accounts, stocks and bonds, earning 15%. See “compound interest” if you don’t understand this point. As well, the person with $100 in a savings account was paying 12% for their mortgage, too, back then, see my comment about the Fed; the dude with $900,000 probably had a Kennedy compound that was inherited and paid for.

Subset on federal debt: While deficits and debt grew under Reagan and O’Neill, it was nowhere near, in actual dollars, compared to the massive debt that has been accumulated under George W. Bush and Barack Obama. In September 1980, just before Carter lost the election to Reagan, the federal debt was $909 billion. In September 1988, just before George H.W. Bush beat Michael Dukakis, the end of Reagan’s term, the debt was $2.6 trillion (about $5.2 trillion in today’s dollars). Reagan and the Democrats in Congress were responsible for an increase of $1.7 trillion in debt across eight years. I remember the freakout about debt at the time; it was legit, too; this amount of debt was astounding.

However, Bill Clinton, with the help of Democrats in Congress for two years, led by Tom Foley, and then Republicans after that (Speaker Newt Gingrich and yes, John Kasich), accumulated nearly as much debt: In September 1992, despite raising taxes after saying he wouldn’t – which led to increased spending, not deficit and debt reduction – HW Bush had accumulated $1.4 trillion in debt across four years. The national debt stood at $4 trillion. In September 2000, the national debt was $5.63 trillion ($7.75 trillion in today’s dollars) or $1.563 trillion just shy of what Reagan accumulated.

Now, compare these debt numbers with W Bush and Obama: By September 2008, W Bush had added $4 trillion to the debt: $9.655 trillion ($10.6 trillion in today’s dollars). The U.S. Debt Clock this morning stands at $19.1 trillion. In other words, Obama, and Speakers Nancy Pelosi, John Boehner, and Paul Ryan, added nearly $10 trillion in debt in less than seven years. How much money is that? The federal government would need to confiscate every penny of the earnings of everyone making more than $74,000 for 12 straight years just to pay off the debt. This doesn’t include future deficits, interest on the debt, pension liabilities, or anything else. Just paying down the debt that the government already has right now. No, I’m not lying, it’s that massive. Raising taxes on individuals and corporations can’t fix this problem.

Subset 2 on federal debt: How, you may ask, can Kasich say with a straight face that he helped “balance the budget” during the Clinton years with Gingrich? Simple, they did … but not by making hard choices to cut/raise/prioritize spending/taxes … they STOLE Social Security surpluses. Clinton left nearly as much debt in eight years as Reagan did. It’s a fact. But you would never know it by listening to pundits and the media. The data is what it is.

Back to the income inequality timeline: In the late 1980s, another recession – the Reagan Hangover Recession – hit, buoyed by real estate speculation, and everyone lost ground until about 1993-1994. Things started to turn around again. But according to the data, from this point until the late 1990s is when the steepest slope of income inequality began to grow. The highest income brackets earned the most income, saved and made more on their investments, and accumulated more wealth than the rest of us. The greatest separation of income inequality occurred under Clinton not Reagan. It’s the steepest climb in the data. Now, again, like under Reagan, the lower brackets also grew. But again, wealth begets wealth. Those people that had money made a killing in the dot-con while other folks got their clocks cleaned.

The second quarter of 2000 is actually when the Clinton/dot-con/911 attack Recession began and again, we see the bottom folks dip a bit and the upper folks dip and level off. At this point though, the people at the top, thanks to Clinton, are already so far ahead of the game it doesn’t really matter if they lose. This level was kept going due to increased economic growth between 2003 and 2007 due to the W Bush tax cuts – which cut taxes for everyone – and assisted in getting the country out of the recession for a short period of time, as noted here by the Heritage Foundation, a conservative think tank. Government revenues actually increased more than expected due to the tax cuts. The problem is that increased government spending, deficits, and debt added to the negative part of those lowered tax rates. So when the real estate market crashed again, due to speculation, people buying homes they never could afford and should have purchased, and con artists on Wall Street packaging those mortgages and saying they were good investments, the entire economy was brought down again and we really haven’t gotten back up (with the exception of the people who already had wealth).

By this time – and most importantly to this entire argument – we also begin to see the ill effects of NAFTA and GATT/WTO trade agreements, ushered in by Clinton and majorities in both of the major political parties in Congress. About 3 million manufacturing jobs were lost between 1994 and 2000, mostly held by lower skill workers who were earning decent wages. Economists note that for every manufacturing job created there are five to seven other jobs connected in the economy to that manufacturing job (for the service sector and retail, it’s another one to two jobs). So another 15-plus million jobs were connected to those 3 million jobs lost. The replacement jobs, the promised white collar jobs, never really materialized; in fact, middle management jobs were cut all over the place to deliver better returns on investments. Service sector jobs were created but they pay much less than the manufacturing jobs did. Less pay for millions and millions continues the separation of wealth … those who were already rich and the rest of us. But it’s worse: Between 2000 and 2016, another 7.3 million manufacturing jobs were lost, according to government data. Tack on another 35 million jobs created around those lost manufacturing jobs, replaced by jobs at 7-Eleven. Remember this when someone – a political candidate, pundit, economist, whoever – brags about a 5.4 percent unemployment rate. It’s a joke. The labor participation rate was 62.9 percent in February 2016. The rate peaked in February 1990, at 66.7 percent and again at 67.3 percent in April 2000. Tens of millions of people are actually out of work.

Subset on labor participation rate: The U.S. has about 320 million people. About 240 million people are over 16 but under 65. In 2013, about 18 million people of all ages were in college. Some were working; some people over 65 were working, too. So, it shifts, but let’s say it’s 220 million of working age. OK. There’s another 10 million on disability (some warranted, some phony). 62.9 percent of 220 million is 132 million. That’s the number of people working, roughly, in some form. That means that 110 million aren’t working in some form. It’s probably closer to 70 or 80 million. But look at the manufacturing data again and it becomes clearer what has been going on economically – policies created by both political parties have shifted the low skill, decent wage work overseas and along with it, massive amounts of income opportunity that the nation always relied on and wealth, too. The already rich got richer from utilizing the policies.

During the 2012 election, when New Hampshire Dems kept bringing up the face that businessmen like Mitt Romney needed to be kept out of the White House because they were shipping jobs overseas, I had to keep reminding them that one guy in the White House – Joe Biden – VOTED for these job killing bills as well as the loosening of banking regulations (hence the Daily Kos joke years ago, it’s “Joe Biden, D-MBNA”). In other words, one of the Senators responsible for the laws and policies WAS ALREADY IN THE WHITE HOUSE. SMH …

Now fixing these issues aren’t as easy, actually, as pointing them out. It’s personal lifestyle choices – do I live with the smartphone I have and save the $900, assuming I have it, as an example (A 20-year-old who saved that $900 and could find a way to earn 6 percent interest annually has nearly $10,000 at age 60). Some folks don’t have money to save and that’s part of the problem. But, as another example, if that same person saves even just $50 a month, $10 to $12 a week, and can find a way to get 6 percent interest annually, that person will have $100,000 in the bank at 60. That’s skipping two pizzas a month. It’s sacrifice, sure. But it’s your choice. Save $100 a month for 45 years, you’ll have $275,000 when you retire at 65. Save $200 and it’s $550,000. This is how an American builds wealth. Yes, I know, we have children, we want a house, we don’t have $200 a month to save, all true. But this is how the “magic wealth fairy” works. Here’s an online calculator – teach your kids now!

Another part is the positive and negative role the government plays in every person’s life. Tax policy, for the most part, just shifts the cost of government – which is already too big and involved in too many things – around. Implementing more surtaxes on the rich doesn’t make the rest of us rich – it just makes them poor. Sure, shifting taxes from us to them gives us some more pennies. But if government continues to grow, we’ll never get the pennies in the first place. Some think growing government more fixes this but it doesn’t. It just creates more government. There are more than 21 million government employees, on every level of government, with trillions in pension liabilities, etc. Our kid’s tax rates are going to be 90 percent whether they earn $50,000 or $50 million to pay for this monstrosity.

Some think raising the minimum wage to $15 will fix this. But, as it has already been shown, that just makes employment costs higher not only for the 3 million people who earn the minimum wage but also everyone in between $7.25 and $15. As an example, from a couple of years ago, an increase in the minimum wage to $15 raises the cost of school and city services here in Concord, NH, with a permanent 2 percent tax increase on top of property taxes that already increase every year. The summer leaf raker at the golf course went from $8 to $15 but homeowners all had to cough up $50 more a year. Since nearly all the homeowners rely on that money, too, it just shifted the money from one person to the next. If the homeowners received no economic increase at all that year, they lose outright, while the leaf raker gains. Never mind all the other increased costs from Market Basket baggers and shelf stockers to waitrons downtown. The companies aren’t going to just eat those costs – they are going to pass them onto you. So, this doesn’t fix the problem and also has negative reverberations in other sections of the economy. This doesn’t include the numerous government labor contracts that increase automatically when the minimum wage goes up. This is the real reason so many union activists want the minimum wage to go to $15 – millions of their employees already earning a lot more than the minimum wage get an instant raise.

The only way to really raise income and wealth is to create a climate where the is competition for workers not jobs. When this happens, companies then compete through higher wages and better benefits for the employee. The employee saves and invests that extra money and becomes more wealthy. This is how it starts. More later…